Digital payments are now the norm as a result of the present pandemic. The Unified Payments Interface (UPI) is a blessing in this regard.

Considered by many to be the greatest financial innovation in India since independence, this quick real-time payment alternative is significantly advancing the push to do away with cash in our economy. Furthermore, it is supporting the growth of our country, which has one of the fastest-growing digital economies in the world.

According to statistics recently collected by the National Payments Corporation of India (NPCI), there were 14035.84 million UPI transactions with a total value of Rs. 20,44,937.05 crore as of May 2024. During this time, there was a startling 108.67% YoY (2023–2024) growth in the overall number of transactions.

The number of banks that have implemented UPI increased to 598 in May 2024 from 422 in May 2023. When the platform was initially released in April 2016, there were just 21 banks using it.

All 50 of the biggest UPI banks enabled 387.85 million customer-initiated transactions totalling Rs. 46,406.52 crores in May of this year.

How come UPI payments?

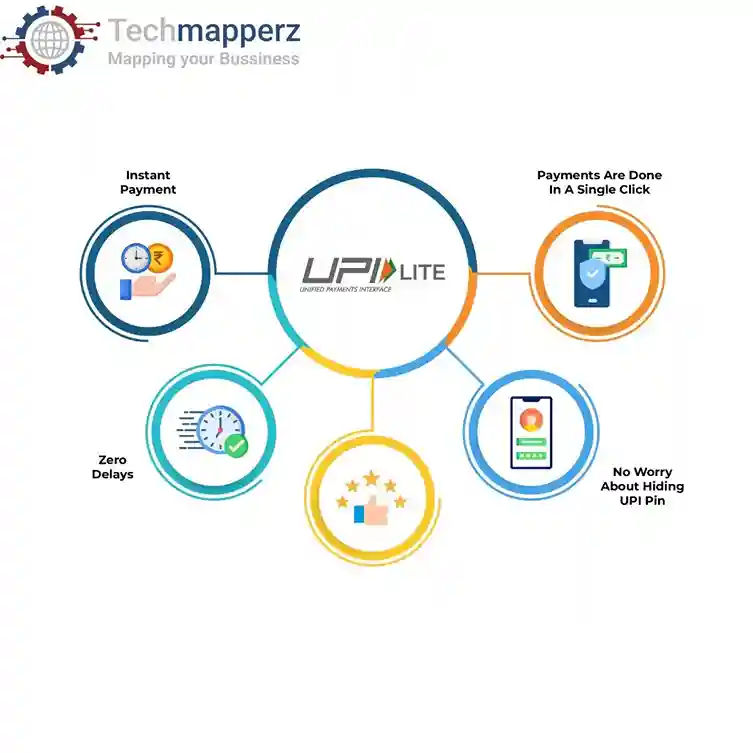

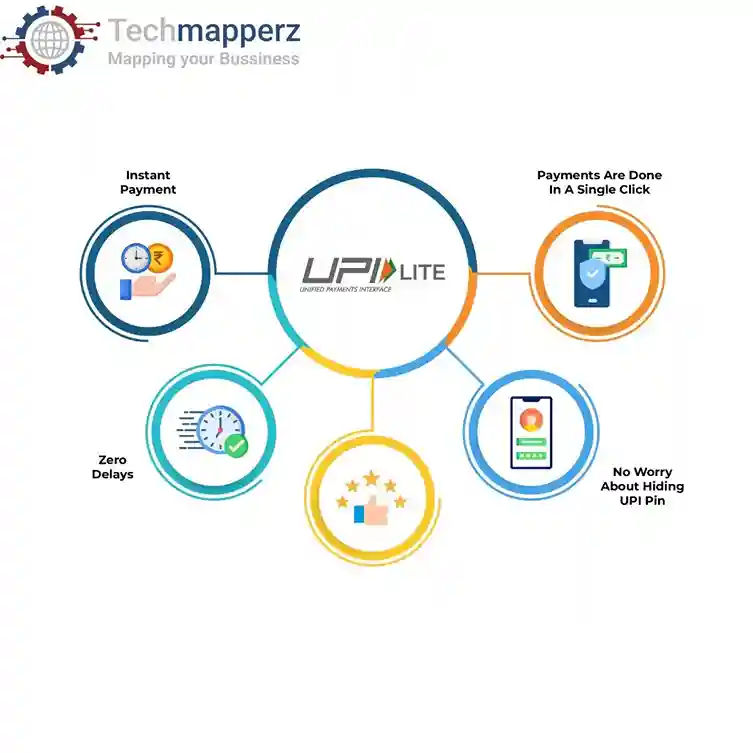

Because of its extremely safe technology and ease of use, UPI has enhanced end users' quality of life and increased their trust in digital payments. However, it also offers a number of benefits to businesses, some of which are as follows:

By setting up a UPI-enabled payment gateway, you may take payments from customers into the bank account of your choice.

With a UPI-enabled payment gateway, you may provide UPI to every one of your clients as an alternate method of payment without having to invest more time, resources, or money to implement this technology.

Consumers that use your app or website with UPI see fewer redirections, which reduces the amount of cart abandonments.

UPI-enabled payment gateways provide high transaction success rates by instantly fetching and displaying the customer's Virtual Payment Address (VPA) on the checkout page.

Why should Paytm Payment Gateway power UPI transactions for your online business?

The Payment Gateway is preferred by many small and medium-sized online enterprises for the following reasons:

1. Provides user-friendly UPI flows for a seamless payment experience.

Customers may pay from any UPI PSP app on their smartphone thanks to UPI Intent, which eliminates the need to switch between the merchant app, UPI app, and SMS.

UPI InApp: This feature shows clients' UPI-connected bank accounts right on the merchant app, improving the payment experience.

UPI Collect: Encourages users to enter their preferred VPA addresses, which makes accepting online payments simpler and more secure.

2. Allow clients to choose their preferred method of payment.

Banks can provide complete UPI solutions to online businesses wishing to enhance their company payments. Paytm is one of the major service providers of UPI-enabled payment gateway for small and medium-sized businesses in India.

With the use of their website or mobile app, retailers can now take payments that go straight into their bank accounts thanks to our UPI-enabled payment gateway. Similar to that, clients can pay using their preferred techniques, such as:

UPI ID (VPA): During checkout, consumers are given the option to pay with their UPI ID.

UPI Apps: Enables users to make payments on their smartphone using their favourite UPI app.

3.High success rates for transactions in the market

The National Payments Corporation of India (NPCI) reported in December 2020 that among all UPI remitter banks and all UPI beneficiary banks has the lowest technical decrease rate at 0.02% and 0.04%, respectively.

With 15 bank gateways and the top six banks. Transaction times, time spent on manual inputs, and reliance on mobile networks are all greatly decreased. From the viewpoint of the customer.

4. Gain access to the enormous consumer base of UPI Account

Your online enterprises will have access to more than 100 million UPI-associated bank accounts of active all users thanks to the UPI InApp flow. By directly displaying their UPI-associated bank accounts on the app, it also improves the end-user experience.

Because there are just two steps needed to handle payments, the transaction time is 0.3 times shorter. In addition, compared to the other two flows, UPI Intent & UPI Collect, the success rate increases by 1.3x.

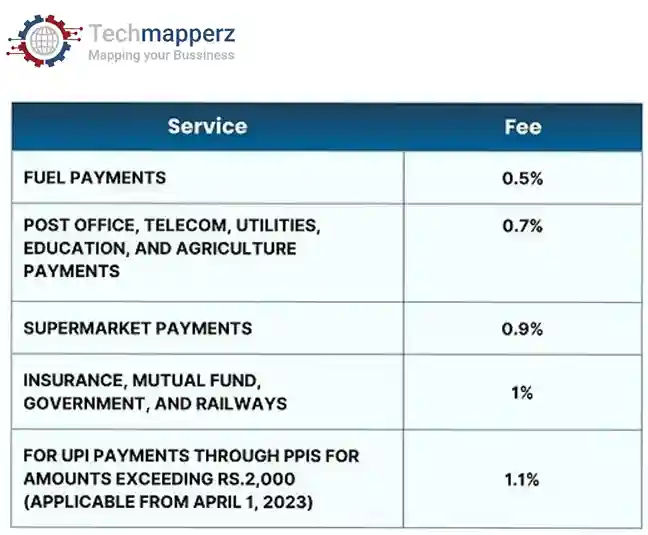

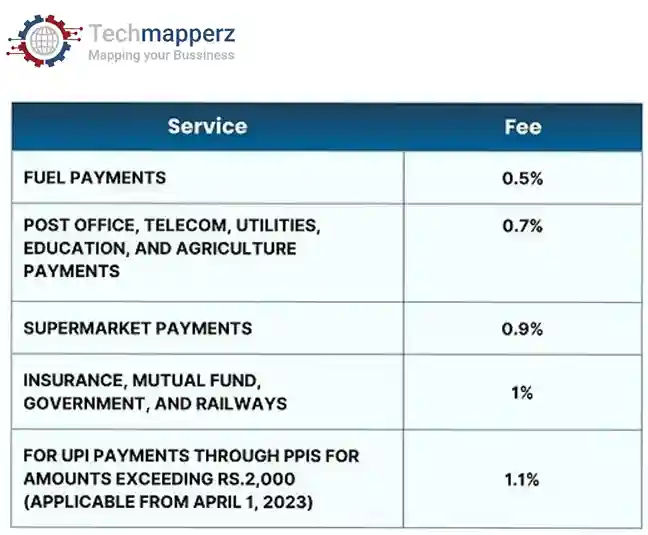

5. There are no transaction fees

For UPI transactions does not charge a fee. You did hear correctly. You can make UPI payments with 0% MDR for the rest of your life. Expect Mobile recharge take 1 to 2 rs charges

![]()

Customer transactions via UPI have increased dramatically as a result of the increase in digital payments in India.

Small and medium-sized firms can also benefit from using UPI because it makes it possible to instantly accept consumer payments around the clock, including on bank and public holidays.

Once the customer verifies the payment, UPI enables businesses to receive payments right away into their selected bank account.

Additionally, there is no payment cap for businesses taking UPI payments. UPI allows businesses to transact without having to pay, making this a viable option.

Conclusion: Techmapperz can optimize your website, and Payment Getaway and UPI can completely transform business payments! Pay with ease, quickly, securely, and without incurring any costs. Real-time bank-to-bank transfers can improve your cash flow management by making it simpler to accept payments from clients and make on-time vendor payments. Give your customers peace of mind with dependable, quick, and easy payment methods. You may effortlessly incorporate UPI for automated, error-free transactions into your current processes. Get insightful information from comprehensive transaction data to improve your strategic planning and financial reporting. Reduce administrative costs while scaling your firm effectively and managing large transaction volumes with ease. With Paytm UPI, you can increase customer happiness and the effectiveness of your GIS service business!

Comments